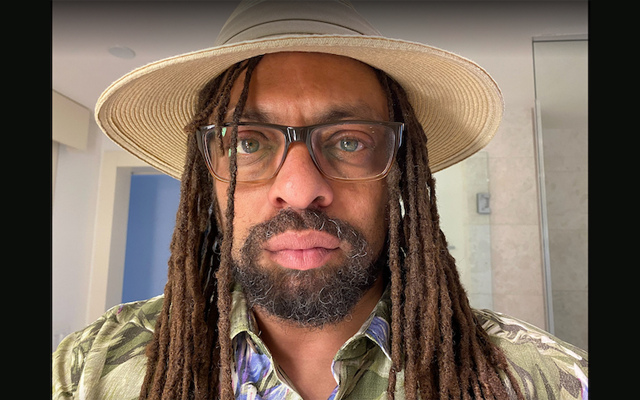

Ed “NJWeedman” Forchion’s personal battles with politicians, the police, the courts, the DEA and even the FBI have been widely documented for decades. Now that the formerly embattled marijuana rebel is finally reaping the spoils of his longtime weed legalization war, he has found himself up against a new foe. With a record of activism that spans over 30 years, Forchion is calling out Instagram as his biggest adversary yet. Though verified on Facebook, the cannabis celebrity has been unable to secure the widely acclaimed blue check for his Instagram account. The matter has caused hundreds of fake accounts to launch and imitate him, much to the detriment of his reputation, businesses and most importantly, his safety.

“My life is in danger because of the fake accounts on Instagram. The situation has gotten wildly out of control. There are impersonators out there literally stealing money online with promises of delivering cannabis. My business does not mail or deliver weed and we don’t conduct any business online ever! I’ve actually had angry customers affront me, my children and my staff in person after having been duped out of thousands of dollars by these scammers online. Some of these situations have gotten very scary! These impersonators are allowed to run rampant, while my team and I have tried repeatedly to secure Instagram’s support and attention,” cites Forchion. “A verified account would at least help to mitigate the situation.”

“I am appealing to the public and our thousands of supporters. I’m hoping that they will report any fake accounts and I’m just trying to get the word out that there is only one real “NJWeedman” account on Instagram, with over 23,000 followers,” notes Forchion. “I’m also filing a report about these cyber-crimes with the FBI in the hopes that their National Cyber Investigative Joint Task Force (NCIJTF) can take on this case. The scammers have fake websites linked to their IG accounts that are impersonating me and they are making off with tens of thousands if not hundreds of thousands of dollars from unsuspecting victims!”

Forchion has achieved worldwide notoriety for his longtime battles for legalization. As the former co-owner of NJWeedman’s Joint, a popular cannabis themed restaurant in Trenton, NJ, six years in business, the famed cannabis culprit made astonishing headlines this past year for opening a dispensary across the street from the state capital city hall. His ‘outlawed’ success has garnered him speaking engagements on virtual panels at Stockton and Princeton University, and he has been featured across international and mainstream news including NBC News in New York, ABC-TV Nightline, Cheddar News, VICE News and MSNBC’s “Into America.”

Forchion has expanded his brand to Miami, FL with the opening of a cannabis friendly art and music lounge, The Joint of Miami. His daughters now oversee his Trenton operations, while his son has taken over the Miami business.

Much to his distress however, even The Joint of Miami business account on Instagram has been hacked and shut down, with imposter accounts now posing as the actual operation. The original account @thejointofmiami, which was linked to major advertisements and publicity, is now replaced by several fake accounts that are compromising the brand’s integrity.

“I know everyone has issues with social media. I happen to love social media. It has given me a voice and a presence that has literally fueled my activism, brand and business ventures. But now, the fake accounts situation has spiraled out of control. I’ve got 99 problems and Instagram is all of them!” adds Forchion. “Adam Mosseri, the head of Instagram, if you are reading this, or any of your team – ‘HELP!’ Can I get verified on Instagram??? Please get me back my @jointofmiami account and delete the fake ones. In fact, we can discuss the matter over a bowl on me!”

For more information about The Joint of Miami, get lit at https://thejointofmiami.com/. Follow them on Instagram only at @theofficialjointofmiami (https://www.instagram.com/theofficialjointofmiami/).

For more information on NJWeedman’s Joint in Trenton, NJ, catch a buzz at https://njweedmansjoint.com/ .

Take a puff with NJWeedman and read all about his continued ‘budding’ adventures at https://linktr.ee/NJWeedman.Most importantly, find him on Instagram only at @njweedman (https://www.instagram.com/njweedman/) and verified on Facebook at @NJWeedman (https://www.facebook.com/NJWEEDMAN).

The post Rebel Cannabis Celebrity Ed “NJWeedman” Forchion Calls Instagram His Biggest Foe Since the DEA first appeared on The Marijuana Times.

Rebel Cannabis Celebrity Ed “NJWeedman” Forchion Calls Instagram His Biggest Foe Since the DEA

Source: Marijuana Times